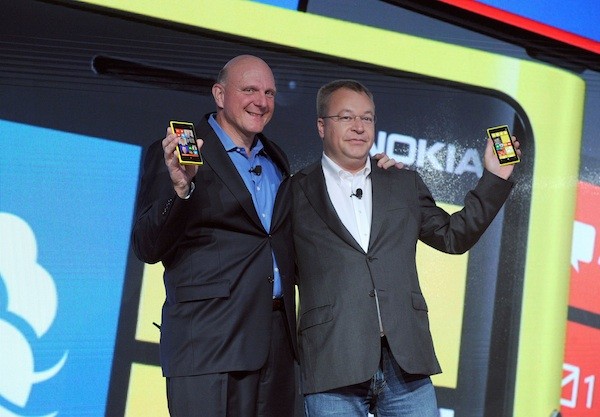

Microsoft and Nokia have been strategic partners for the manufacture of Windows Phone devices for a couple of years. Microsoft helped the company bail out of its financial woes when Nokia took 1 Billion USD to exclusively manufacture Windows Phone devices and drop plans to make devices on Android, Symbian and Meego. Microsoft’s acquisition of Nokia comes in after the successful transition of Motorola into Google, for the company may be a proud owner of a high tech manufacturing brand. Such an acquisition will enable Microsoft to manufacture devices as per their own set norms and create benchmarks for other partners. Along with the hardware and services Microsoft will also become the owner of a wide array of patents and licenses that Nokia owns, one of which earns US $ 1 for every iPhone sold.

Microsoft puts it out there, the company claims that buying a manufacturer like Nokia will enable Microsoft to deliver a

“first-rate Microsoft phone experience for users”.

Microsoft has been trying to be a hardware manufacturer in the past few years, as it attempted with the “bust” Windows RT and 8 based Surface Tablets, the Acquisition of Nokia could lead to new Hardware under the Microsoft name in the mobility segment. What the future of the once world leader in Mobile telephone will be post the acquisition is unknown, but we hope that this does not pan out similar to the HP – Palm acquisition, which ended the life of a very innovative company.

Microsoft could easily be blamed for this acquisition as well, 3 years ago Nokia was valued at well over US $ 25 Billion, Microsoft’s so called “Strategic Partnership” basically ended the marketshare that Nokia had enjoyed in the good old days of Symbian and S40. Analysts claim, if Nokia had stuck to new operating systems like Meego and relatively young Android ( at the time), the company would have prospered and would have been close to the likes of Samsung and Apple in number of movements.

Today Nokia heavily depends on its feature-phone sales for its revenues, and in a global world where the 100$ smartphone is overtaking the 100$ feature phone, Nokia may have realized the limited lifecycle it had left.

Microsoft is no stranger to takeovers, and with many a past companies under its sleeve, Nokia would be more of a trophy, just so the execs at Redmond can say “Hey, We manufacture our own phones! Just like Apple and Google.”

Microsoft really has an opportunity, with the vast array of designers and young minds at Nokia, years of experience and a complete team of experts in mobility, maybe the top brass at Microsoft will be more open to world changing ideas, than they were back at Nokia. Heck in 2006 a fully capacitive touchscreen phone was rejected within the Finland HQ at Nokia stating that the world was not ready for a full touch phone. In 2007 June, the iPhone was launched, Nokia couldn’t have been more wrong.