Google has announced the launch of its new India-centric UPI based mobile payments app, Tez. The search engine giant’s new app will let users link their smartphones to their bank accounts to pay for goods securely in physical and online stores, and for person-to-person money transfers.

Payments made straight from your bank account, big or small. Presenting #GoogleTez, money made simple. https://t.co/yb71ezw9Ol pic.twitter.com/Ywy6xJf2qj

— Google Pay India (@GooglePayIndia) September 18, 2017

The information portal of Tez reads

Send money home to your family, split a dinner bill with friends, or pay the neighbourhood chaiwala. Make all payments big or small, directly from your bank account with Tez, Google’s new digital payment app for India

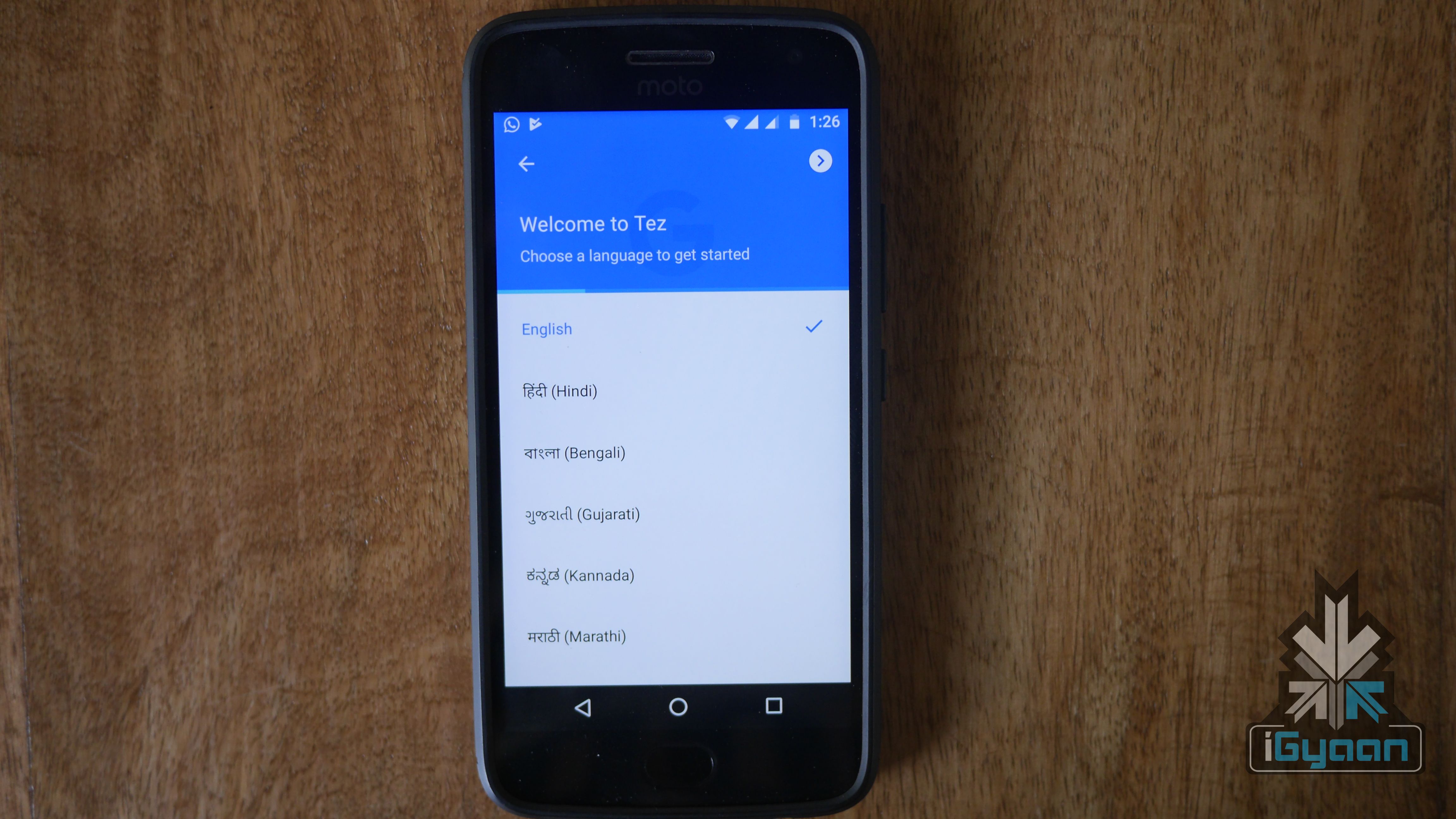

The app will be available to download on all iOS and Android devices. The payments app will tie up with several banks through Unified payments Interface (UPI), a payment system backed by the government in its push to bring more integrated banking services in the Indian market. Supported banks include Axis, HDFC Bank, ICICI and State Bank of India and other banks that support UPI. Online payment partners include food chains like Dominos, transport services like RedBus, and Jet Airways. To help address one of the most important factors that make or break an online service in the Indian market, the app has support for English, Hindi, Gujarati, Kannada, Marathi, Bengali, Tamil, and Telugu. Tez features a technology called audio QR that allows users to transfer money using sounds to pair two devices. Called the “cash mode option,” phones negotiate a connection using audio to identify the payer and payee.

It is worth noting that the app is not a digital ‘wallet’ like PayTM wherein the money is stored in the app and is topped up for purchases. The Google Tez is more like Apple Pay where the app links your phone with your bank accounts to let you use your phone as a way to deduct payments from those accounts. There is also has a separate business portal for sellers to register themselves and accept payments through Tez itself.

India has seen a fast growth of online payment apps like PayTm in the past few years and last year’s demonetization further fueled this growth. UPI is a payment system launched by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India which makes the instant fund transfer between two bank accounts on the mobile platform possible. There have been reports suggesting that the infrastructure of digital payments in India is expected to grow three-fold by the end 2017. Talking about the meteoric growth of online payments in India, Secretary of the Ministry of Electronics and IT said

We expect that by December, the number will actually go up to five million PoS(Point of Sales), which means that the infrastructure for digital payments is going to grow three times in the short span of one year.

Tez enters the Indian market at a time when the online payment industry has just started seeing an exponential rise. The app offers a different service than PayTM, the most successful UPI payments app in India right now and might be able tp differentiate itself from PayTM but it may take a while before people accept Tez as their primary mobile payments app.