Google Inc. has officially announced the NFC based Mobile wallet payment service, in the United States. The Service comes with tie-ups and offers from retail and financial partners including Subway, Macy’s, Walgreens, Toys ‘R Us, First Data, Citibank and MasterCard.

At the Get go Nexus S 4G will be the only compatible phone, “over time, more phones will be supported” and Google even suggested that phones without built-in NFC could simply use an NFC sticker (the Google Wallet app itself will work on non-NFC phones as well). Only Citi MasterCard or Google Prepaid Card with the service, the Google prepaid card can be purchased through any existing card.

Google, Citi, MasterCard, First Data and Sprint Team up to Make Your Phone Your Wallet

Google Wallet will enable consumers to tap, pay and save with their phones

NEW YORK–(BUSINESS WIRE)–At an event today, Google, Citi, MasterCard, First Data and Sprint announced and demonstrated Google Wallet, an app that will make your phone your wallet so you can tap, pay and save money and time while you shop. For businesses, Google Wallet is an opportunity to strengthen customer relationships by offering a faster, easier shopping experience with relevant deals, promotions and loyalty rewards.

“Macy’s is always looking for cutting-edge technology that will deliver value and engage our customers in personal ways. Google Wallet delivers this unique interaction across channels.”

“Today, we’ve joined with leaders in the industry to build the next generation of mobile commerce,” said Stephanie Tilenius, vice president, commerce and payments, Google. “With Citi, MasterCard, First Data and Sprint we’re building an open commerce ecosystem that for the first time will make it possible for you to pay with an NFC wallet and redeem consumer promotions all in one tap, while shopping offline.”

Google Wallet is currently in a field test and will be available to consumers this summer. At the event, Google, Citi, MasterCard, First Data and Sprint introduced Google Wallet and invited additional issuing banks, payment networks, mobile carriers, handset manufacturers, point of sale systems companies and merchants to join the initiative.

Next Step in Mobile Payments

At commercial launch, Google Wallet will support payments with two payment solutions: a PayPass eligible Citi MasterCard and a virtual Google Prepaid card. Most people who already have a PayPass eligible Citi MasterCard can simply add it to Google Wallet over the air, using First Data’s trusted service manager service. Or, they can fund the Google Prepaid card with any payment card.

Google Wallet uses near field communication (NFC) to make secure payments fast and convenient by simply tapping the phone on any PayPass-enabled terminal at checkout.

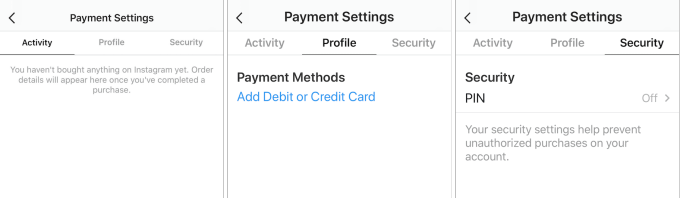

Google Wallet is engineered to enable secure payments and goes beyond what’s possible with traditional wallets and cards. It will require an app-specific PIN and in the first release, all payment card credentials will be encrypted and stored on a chip, called the secure element, that is separate from the Android device memory and is only accessible by authorized programs.

“Citi’s role as the lead bank in Google Wallet is the latest demonstration of how we are committed to becoming the world’s digital bank, providing to customers the tools they need to manage their everyday finances with convenience and value,” said Paul Galant, CEO, Citi Global Enterprise Payments. “Today’s announcement and our active collaboration with Google will be looked at as the inflection point for how mobile payments are evolving from concept to mass utilization.”

Accepted in Stores Nationwide

Google Wallet is built to work with the fast growing MasterCard PayPass network-a merchant point of sale service that enables consumers to tap to pay. As a result, Google Wallet will immediately be accepted at more than 124,000 PayPass-enabled merchants nationally and more than 311,000 globally.

“MasterCard has pioneered mobile payments with our PayPass technology and we’re proud that it is at the heart of Google Wallet,” said Ed McLaughlin, chief emerging payments officer, MasterCard. “We’re excited to partner with these industry leaders today and committed to continuing to play a leadership role in the development of mobile payment technologies.”

Google is also working with point of sale systems companies and top retail brands to create a new SingleTap shopping experience. Consumers will be able to pay for an item using a credit card or gift card, redeem promotions and earn loyalty points-all with a single tap of their Google Wallet. Google is working with VeriFone, Hypercom, Ingenico, VIVOTech and others to develop these next generation point of sale systems. Retailers participating in the new SingleTap experience include: American Eagle Outfitters, Bloomingdale’s, Champs Sports, The Container Store, Duane Reade, Einstein Bros. Bagels, Foot Locker, Guess, Jamba Juice, Macy’s, Noah’s Bagels, Peet’s Coffee & Tea, RadioShack, Subway, Toys”R”Us and Walgreens.

“Google Wallet allows us to harness the power of mobile technology to enhance our in-store shopping experience and helps bridge the gap between our online and in-store consumer interactions,” said Martine Reardon, executive vice-president of marketing and advertising, Macy’s. “Macy’s is always looking for cutting-edge technology that will deliver value and engage our customers in personal ways. Google Wallet delivers this unique interaction across channels.”

The first Google Wallet field tests are focused in New York and San Francisco, where many retailers, Coca-Cola vending machines and even taxis are PayPass-enabled, including major outlets such as CVS, Jack in the Box, Sports Authority and Sunoco. First Data, a global leader in electronic commerce and payment processing, is actively recruiting thousands of new merchants in these areas and will soon expand those efforts to deploy more contactless merchant terminals across the country.

“The payments industry has known for some time that it was not a question of if, but when true mobile commerce would become a reality. We believe today is the day that mobile meets payments,” said Ed Labry, president, North America, First Data. “We’re proud to play a central role in Google Wallet and to bring innovative technology such as Trusted Service Management and contactless acceptance to our clients.”

Saving Made Simple

Google has also been testing a variety of consumer deals that can range from a 20-percent discount on a new pair of boots discovered on a Google search advertisement; to a $5 off check-in offer received upon entering a store; to a “deal of the day” offering a $20 lunch for $10 at a local restaurant. Whenever you buy or save an offer, you will be able to automatically sync it to Google Wallet.

At most stores you will be able to use Google Wallet to show your offer at the register, where the cashier will either scan it or manually type it in. At participating Google SingleTap merchants, you will be able to pay and redeem an offer with one tap of your mobile device.

Because Google Wallet is a mobile app, it will eventually be able to do more than a regular wallet ever could-but without the bulk. Google Wallet will start with offers, loyalty and gift cards but some day items like receipts, boarding passes and tickets will all be seamlessly synced to your Google Wallet.

Open Commerce Ecosystem = Consumer Choice and Innovation

Google Wallet will work best if it’s an open commerce ecosystem so you will be able to carry all the credit cards, offers, loyalty and gift cards you choose-and eventually much more. To this end, Google Wallet will make it possible to integrate numerous types of partners, and Google, Citi, MasterCard, First Data and Sprint invite the banking community, mobile carriers, handset manufacturers, merchants and others to work with Google Wallet.

“We are delighted to be the first carrier to sign on as a partner with Google to deliver Google Wallet,” said Fared Adib, senior vice president of product development, Sprint. “As a leading innovator and proponent of “open,” we are proud that Nexus S 4G is the first smartphone with Google Wallet and we look forward to deploying Google Wallet on many of our upcoming Android phones.”

The first release of Google Wallet is expected to be released on the Nexus S 4G on the Sprint network. Additional devices with NFC capabilities will follow. Sign up to be notified about the release at google.com/wallet.

About Google Inc.

Google (NASDAQ: GOOG) is a global technology leader focused on improving the ways people connect with information. Google’s innovations in web search and advertising have made its website a top internet property and its brand one of the most recognized in the world. For more information, visit www.google.com/about.html.

About Citi

Citi, the leading global financial services company, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Through Citicorp and Citi Holdings, Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services and wealth management. Additional information may be found at www.citigroup.com.

About MasterCard

As a leading global payments company, MasterCard (NYSE: MA) serves as a franchisor, processor and advisor to the payments industry, and makes commerce happen by providing a critical economic link among financial institutions, governments, businesses, merchants and cardholders worldwide in more than 210 countries and territories. For more information, please visit us at www.mastercard.com. Follow us on Twitter: @mastercardnews.

About First Data

Around the world, every second of every day, First Data makes payment transactions secure, fast and easy for merchants, financial institutions and their customers. First Data leverages its vast product portfolio and expertise to drive customer revenue and profitability. Whether the choice of payment is by debit or credit card, gift card, check or mobile phone, online or at the checkout counter, First Data takes every opportunity to go beyond the transaction.

About Sprint

Sprint Nextel offers a comprehensive range of wireless and wireline communications services bringing the freedom of mobility to consumers, businesses and government users. Sprint Nextel served more than 51 million customers at the end of 1Q 2011 and is widely recognized for developing, engineering and deploying innovative technologies, including the first wireless 4G service from a national carrier in the United States; offering industry-leading mobile data services, leading prepaid brands including Virgin Mobile USA, Boost Mobile and Assurance Wireless; instant national and international push-to-talk capabilities; and a global Tier 1 Internet backbone. Newsweek ranked Sprint No. 6 in its 2010 Green Rankings, listing it as one of the nation’s greenest companies, the highest of any telecommunications company. You can learn more and visit Sprint at www.sprint.com or www.facebook.com/sprint and www.twitter.com/sprint.

According to Deutsche Bank analyst Kai Korschelt, The dying breed Nokia stands to sustain in the market thanks to is greatest rival today – Apple. Apple and Nokia announced early on Tuesday that they had reached an agreement regarding a series of patent disputes filed by each company over the past few years.

According to Deutsche Bank analyst Kai Korschelt, The dying breed Nokia stands to sustain in the market thanks to is greatest rival today – Apple. Apple and Nokia announced early on Tuesday that they had reached an agreement regarding a series of patent disputes filed by each company over the past few years.