Telecommunications Research Institute of the Ministry of Industry and Information Technology recently released a report on the domestic phone shipments in China and it does not look too good for the smartphone market. In the period from January-September 2018, the domestic mobile phone market shipped 305 million units, down 17% year on year. September 2018 saw 91 new model launches, down 26.0% year-on-year and 65.5% quarter-on-quarter. 18 models of 2G phones, 1 model of 3G phones and 72 models of 4G mobile phones saw their release in that month.

Reports also stated that in the period of January to September 2018, 2G mobile phone shipments were 16.762 million units, down 19.7% year-on-year. 3G mobile phone shipments were 49,000 units, down 90.9% year-on-year. While the 4G mobile phone shipments were 288 million units, down 16.7% year-on-year.

635 new phones were launched since the beginning of the year. Out of this, 144 models were 2G compatible and 488 models were available with 4G support. 92% of the sales were garnered by the top 10 manufacturers in China. This includes giants like Xiaomi, Oppo and Apple.

Around The World

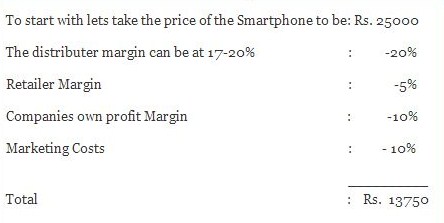

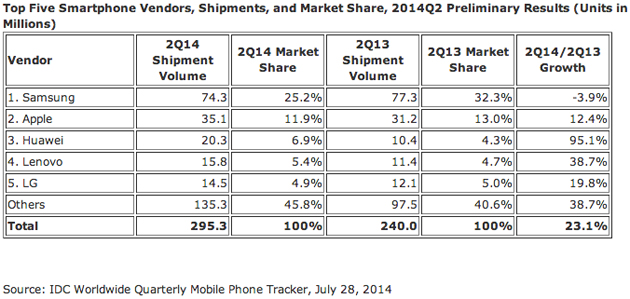

September also saw Korean smartphone manufacturers Samsung beating Apple in the global smartphone market. This is hapenning as companies like Xiaomi, Huawei and Oppo are closing in. Apple however targets the top end of the market while most Chinese manufacturers target the lower end. This is much more price sensitive. Other manufacturers may win the race in terms of the number of phones sold but Apple almost always wins the profitability race.

In Quarter 2, according to a research website, the best selling smartphone models were the Oppo R15, Vivo X21, iPhone X, iPhone 8 Plus and Honor 7C. A research analyst when talking about Q2 had commented that during the quarter, OPPO and Vivo also expanded their presence in the premium segment by launching devices like the Find X and Nex. According to him, the premium segment is likely to get more competitive in the later part of 2018.