A gang of fraudsters have reportedly stolen $19 million (approx. Rs. 132 crores) worth of iPhones over the past seven years in the United States of America. The FBI and NYPD aptly named the gang ‘Fraud Ring’, which was run by six people that called themselves ‘Top Dogs’. The gangs used counterfeit debit cards and fake IDs to buy new iPhones to be sold for high prices in the black market.

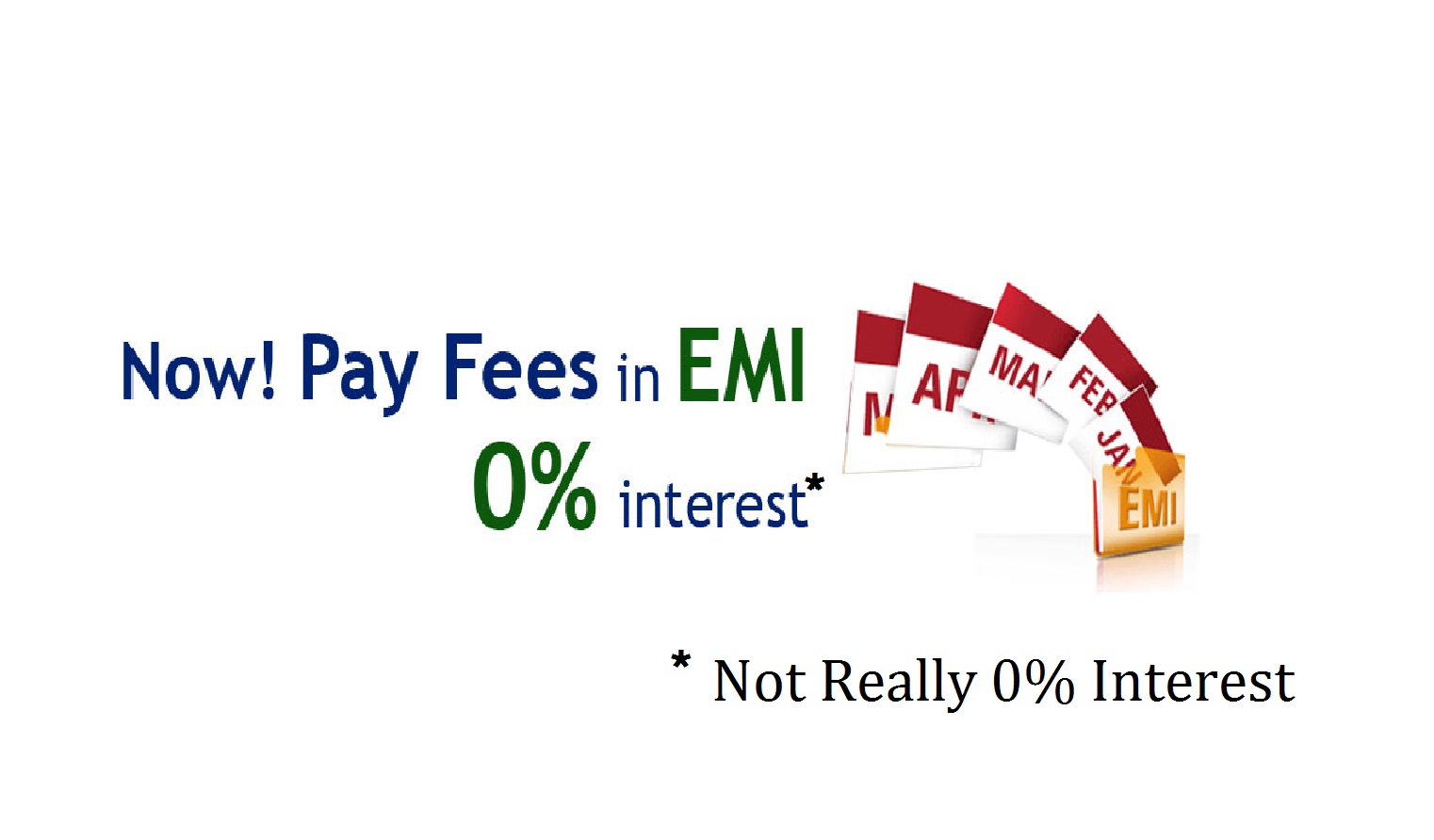

The payment method that involved instalments enabled the scam to go undetected. A detailed report has been uploaded online regarding the fraud case. The victims of the scam included customers whose accounts were compromised along with respective carriers. The gang, possessing the debit cards and fake identification bought iPhone units from stores posing as the original account holders. The reason listed by the scammers was to upgrade to a newer handset on their previously existing accounts. Fraudsters stretched the scammed devices instalments over many months, that later showed up on the actual customer’s bill.

The perpetrators are being charged with felony counts of mail fraud, conspiracy, and aggravated identity theft. A total of 34 states in the US were affected while the exact number of individuals have yet to be disclosed. One of the accused co-operated with the authorities and revealed the workings of the Fraud Ring in exchange for a reduced sentence. It has been reported that the ‘Top Dogs’ took the largest chunk of the revenue, while the middlemen were responsible for all illegal activities like stealing identities by scamming customers. The bottom level involved drivers and runners that made rounds to various destinations to commit the fraud and ship the iPhone units back.

The co-operating witness claimed to have joined the gang in 2013 and has made about 18 trips in total. Fraud Ring paid $100 for each iPhone that was stolen by him during that period. A shipping company (back in 2014) was discovered in possession of 250 phones, fraud cards, driver’s licenses, and passports after an employee opened one of the packages.

Also Read: Astrobotic’s Tiny Rover To Test Endurance Of Small Robots On The Moon

This incident is reported to be one of the largest smartphone scams to date in terms of the value of stolen devices. Similarly, a group of scammers was accused of stealing 1,300 iPhones worth $1 million in 2018. Many such scams have been surfacing recently as fraud is being taken more seriously by the Government and investigating agencies.