A press release has announced the partnership of BlackBerry Limited with LG Electronics Inc. for a major new project. The aforementioned brands are recognisable for their consumer grade electronic products. However, the new project that is being spearheaded by the two companies will encompass the automobile industry, namely self-driven (autonomous) cars.

Historically, LG and BlackBerry were popular smartphone brands. The companies were critically acclaimed worldwide for their handsets, including India. The onset of the smartphones industries tech race had rendered BlackBerry and its business-centric devices obsolete. LG faired much better in comparison but has also seen a decline in the last couple of years. Though, the company is well known for its home appliances such as televisions and refrigerators.

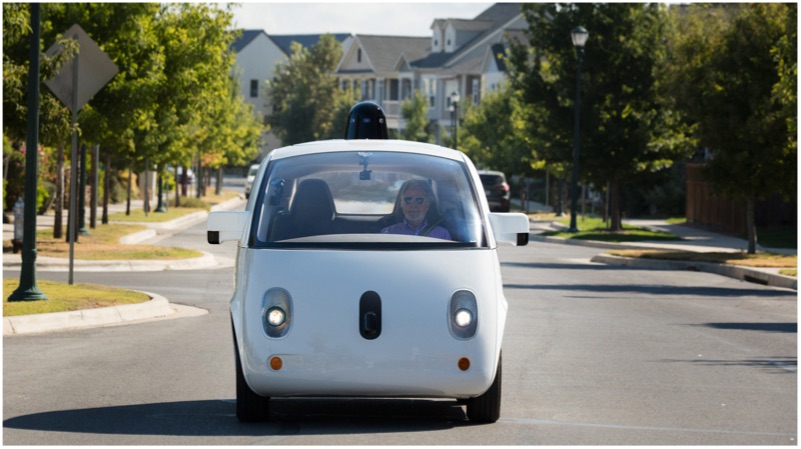

The new project for autonomous cars is a heavy task. Self-driven cars are unlikely to hit Indian market anytime soon but are already being tested in developed nations like the US. Google, Apple, Uber and other such companies have been testing the technology for a while now. The automobile industry would greatly benefit from the expertise of both the companies in the arriving years.

The new agreement formed between the companies carries statements of the joint expansion through the partnership. Both the companies are large corporations that have only a small part of their business models aimed at the smartphone industry. Blackberry is well-renowned for its QNX software-based services and safety solutions that are being utilized by a multitude of companies.

The companies have formed a conjunction to push forward the development and commercial availability of autonomous vehicles. The entire automobile industry has been working on numerous autonomous locomotives for years now. This new collaboration will seek to accelerate the transitional process between traditional to self-driving cars. The project will encompass a network of self-driving vehicles that are connected to one another. It will also help boost the myriad of suppliers that automobile OEMs are working with.

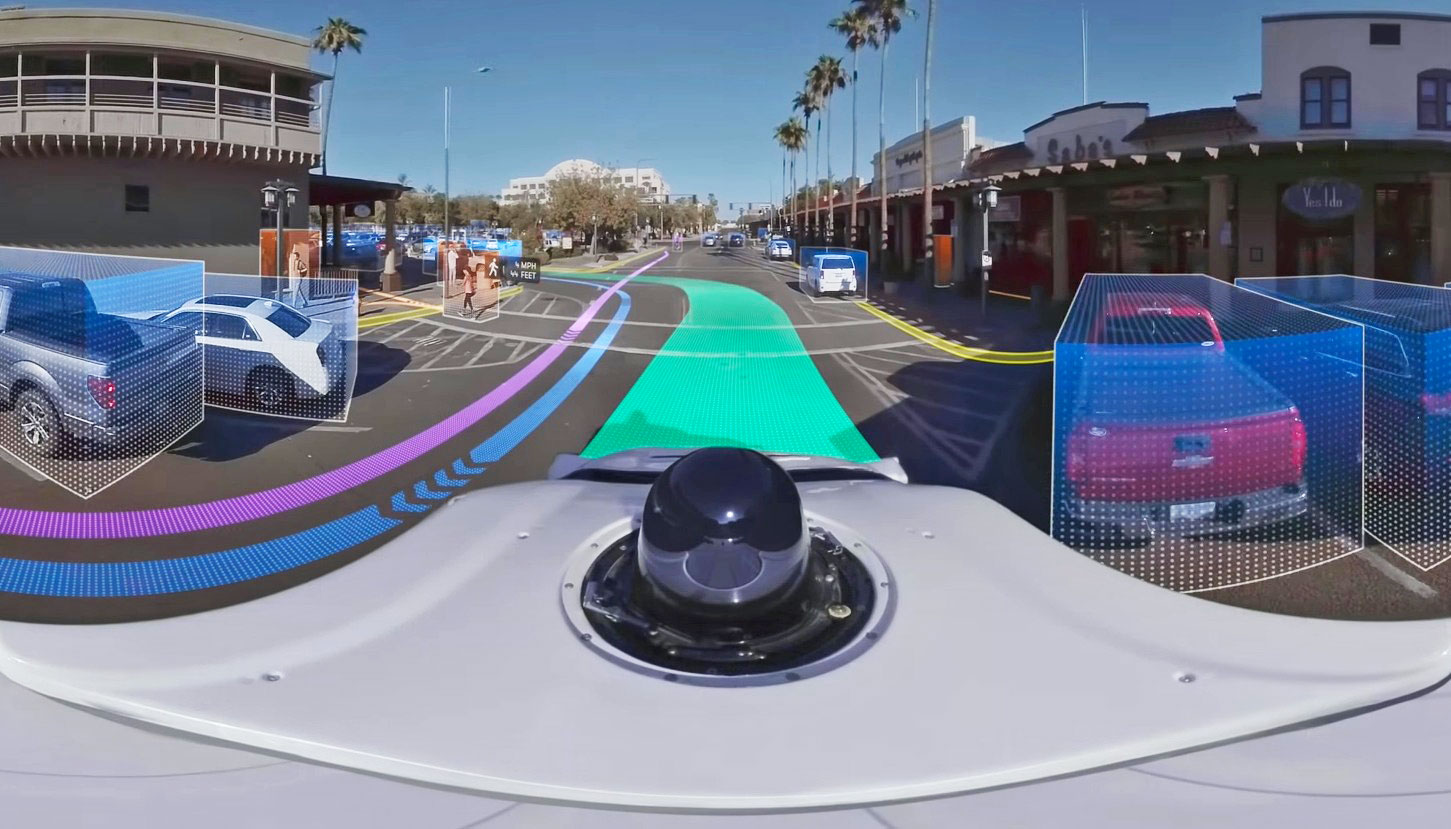

According to the report, BlackBerry’s QNX-based software solutions are planned on being incorporated by LG Electronics. The South Korean company’s hardware expertise will use QNX solutions to build numerous next-gen components such as:

- A security solution designed to help safeguard the system against malware and cyber threats and prevent malfunctions.

- Incorporate an improved voice and sound quality systems, namely media entertainment system, for the car’s internals.

- To build the control system for autonomous cars.

- An accessible mobile interface with control over multimedia functionalities.

Furthermore, the companies’ goals are to “produce cutting-edge cars for the future of the automotive market”. BlackBerry, unlike LG, has shifted its focus on its software services that are used in the mobile and automobile industry. The Canadian company is already supplying its technology to manufacturers developing driverless cars. LG, however, is still present in the smartphone market with its latest W series entries being launched in India. The company is still a big name in household products and is planning diversification in new ventures such as this.

Also Read: WhatsApp Tests Feature That Allows Sharing Status To Facebook

The implications of the joint venture could be huge. Both LG and BlackBerry could potentially reduce the time frame for commercially available self-driving cars. The companies will rely on each other’s strong suits for the partnership. It might not be too long before the project bears its fruits. Unfortunately, it is just an announcement and not an actual product launch. We are still years away from actually seeing such cars in real-world practice.