For most of the transactions, we use physical currency. However, that goes out the window once most of your currency is demonetised. But, thanks to some really good e-wallet apps, transactions are not that difficult. So, let’s have a look at the top 3 e-wallet apps in India.

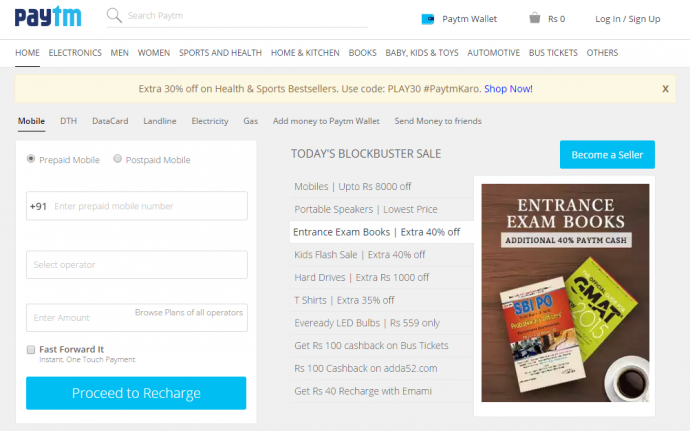

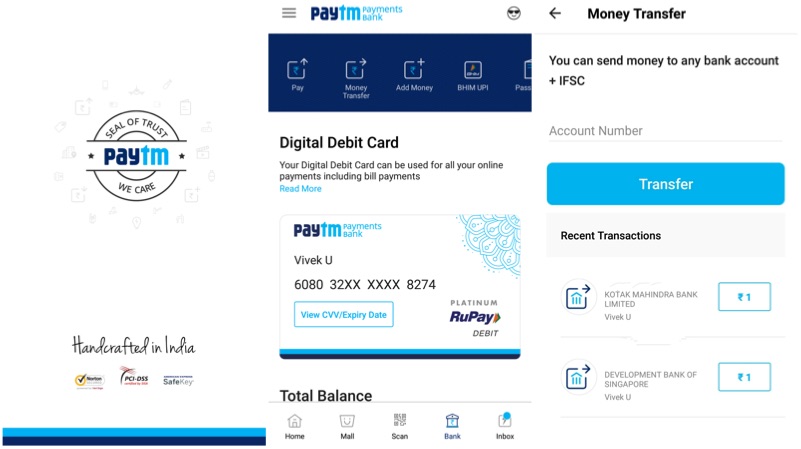

Paytm

Paytm is probably the first widely accepted e-wallet service in India. It can be accessed using an iOS or an Android smartphone. In fact, one can also access it using any of the standard web browsers. The platform comes with features like Paytm Wallet, where a user can use the wallet to make seamless transactions. Recently, Paytm has also started the Paytm payments bank, where the user can create a virtual savings bank account and get its own physical debit card. The platform also offers the ability to transfer money to bank accounts for a nominal fee. Paytm can be used to recharge mobiles, DHT, paying electricity bills, paying college tuition fees etc.

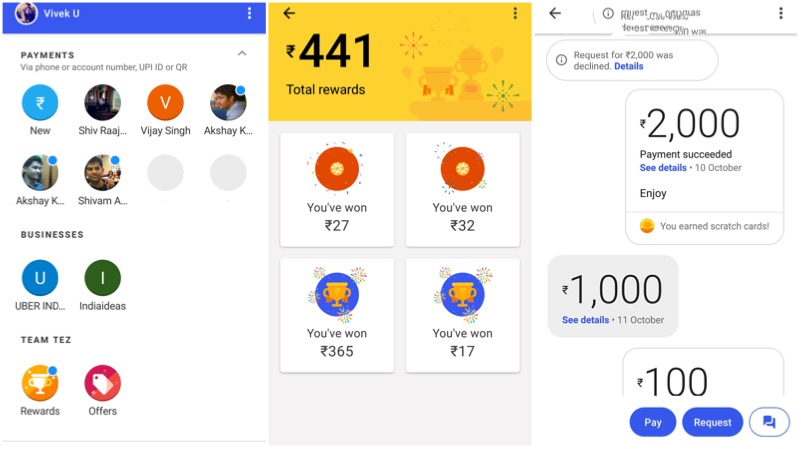

Google Tez

Google Tez is the newest member of the e-wallet group. Unlike most of the e-wallets, Tez does not have the wallet service. The money sent/received will directly reflect in the user’s bank account. To use Google Tez, one has to have an active bank account with the Unified Payment Interface (UPI). Tez also offers coupons in return for the transactions. A user can win from Rs 1 to Rs 1,00,000by scratching those coupons on Google Tez. One can link the UPI account created on Tez to the third party apps like Uber. Similarly, one can invite others to Google Tez to earn Rs 51.

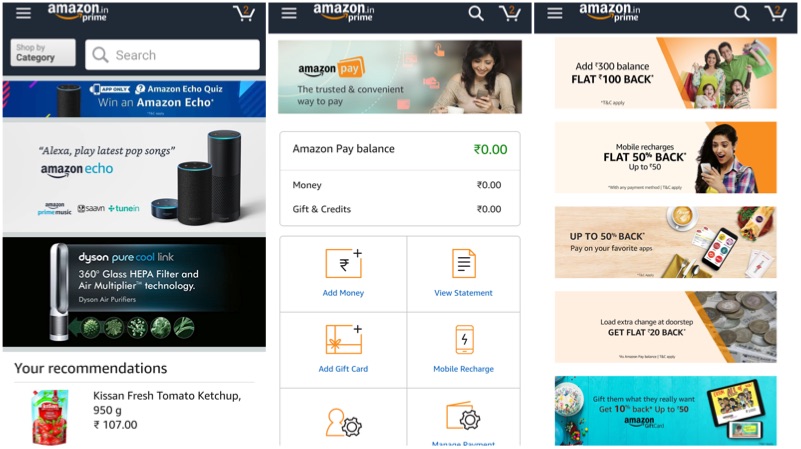

Amazon Pay

Amazon Pay is similar to Paytm with an Amazon Wallet. As the name suggests, this feature is initiated by Amazon, which can be used to shop on Amazon. However, one can also use this feature to pay the post-paid account bills, recharge pre-paid numbers and can be used with other services like Bookmyshow and Tapzo. Amazon Pay comes with additional perks like 50% cashback on recharges, Rs 100 back by adding Rs 300 to the wallet and more. If you are an online shopping junkie, then this a must have e-wallet service.