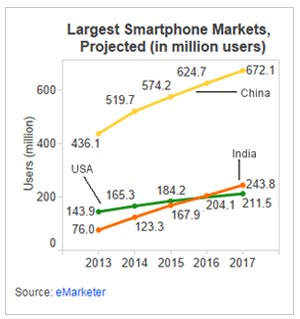

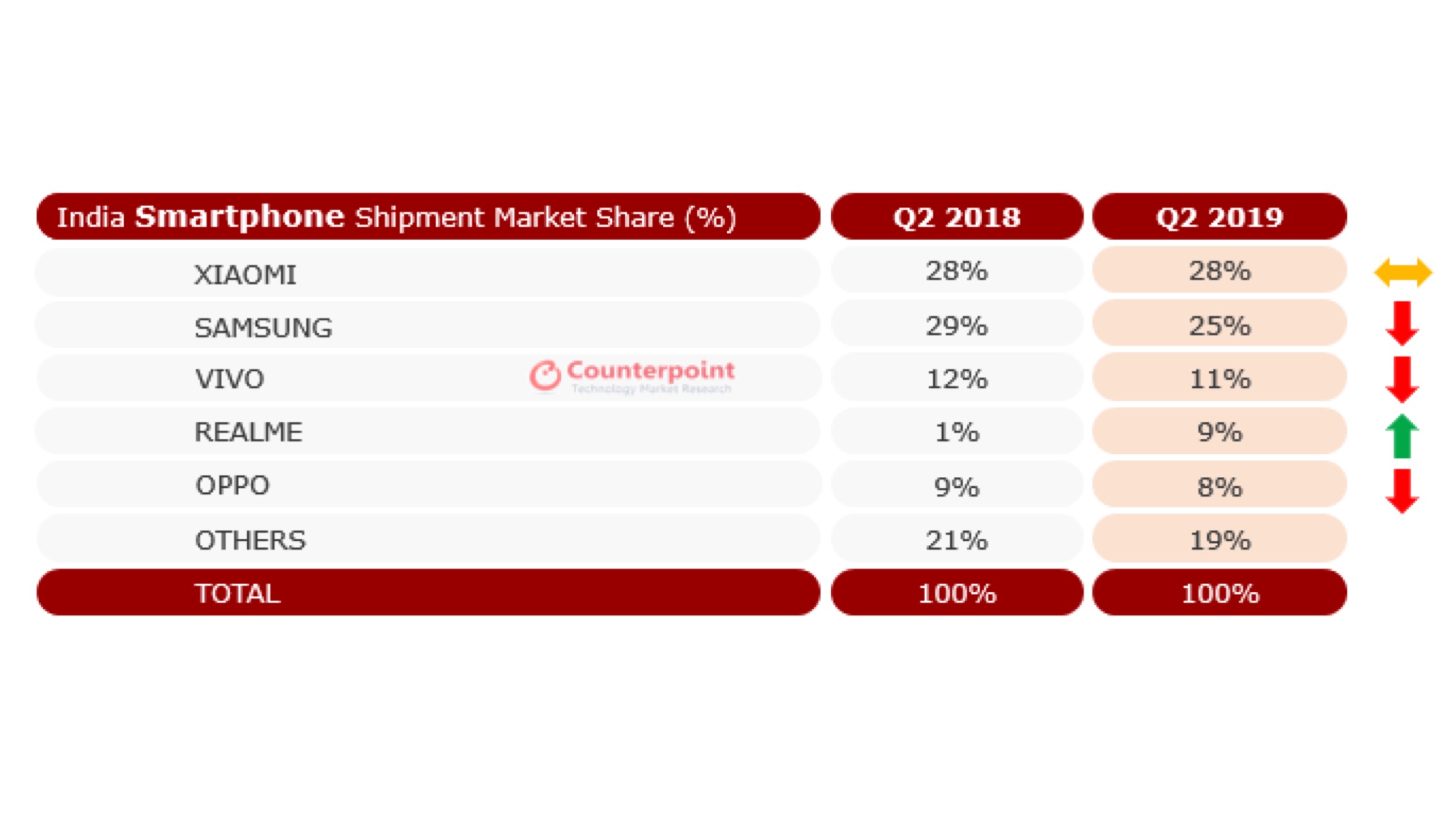

India is currently one of the largest smartphone markets and is also amongst the fastest growing one as well in the industry. According to a new report, the Indian smartphone market has broken previous records with a massive 37 million units being shipped in just the second quarter of 2019 alone. The increase is just a single digit growth but which the country gains steadily after each passing year.

Counterpoint, a research and analytical firm, has reported via its Market Monitor services that “the growth was driven via new launches, price cuts on older devices and channel expansion across brands.” One of the contributing factors were the expansion of offline centric brands to online stores. It includes online-website exclusive series which have helped boost sales of certain brands like OPPO and Vivo. In a similar fashion, brands that had been online exclusive have now shifted to offline shelves with partnerships with key retailers like OnePlus. Notably, various OEMs have seen success targetting multiple demographics within one series of smartphone that sport different specifications and price in the Indian smartphone market; similar to a flagship and its more inexpensive variants.

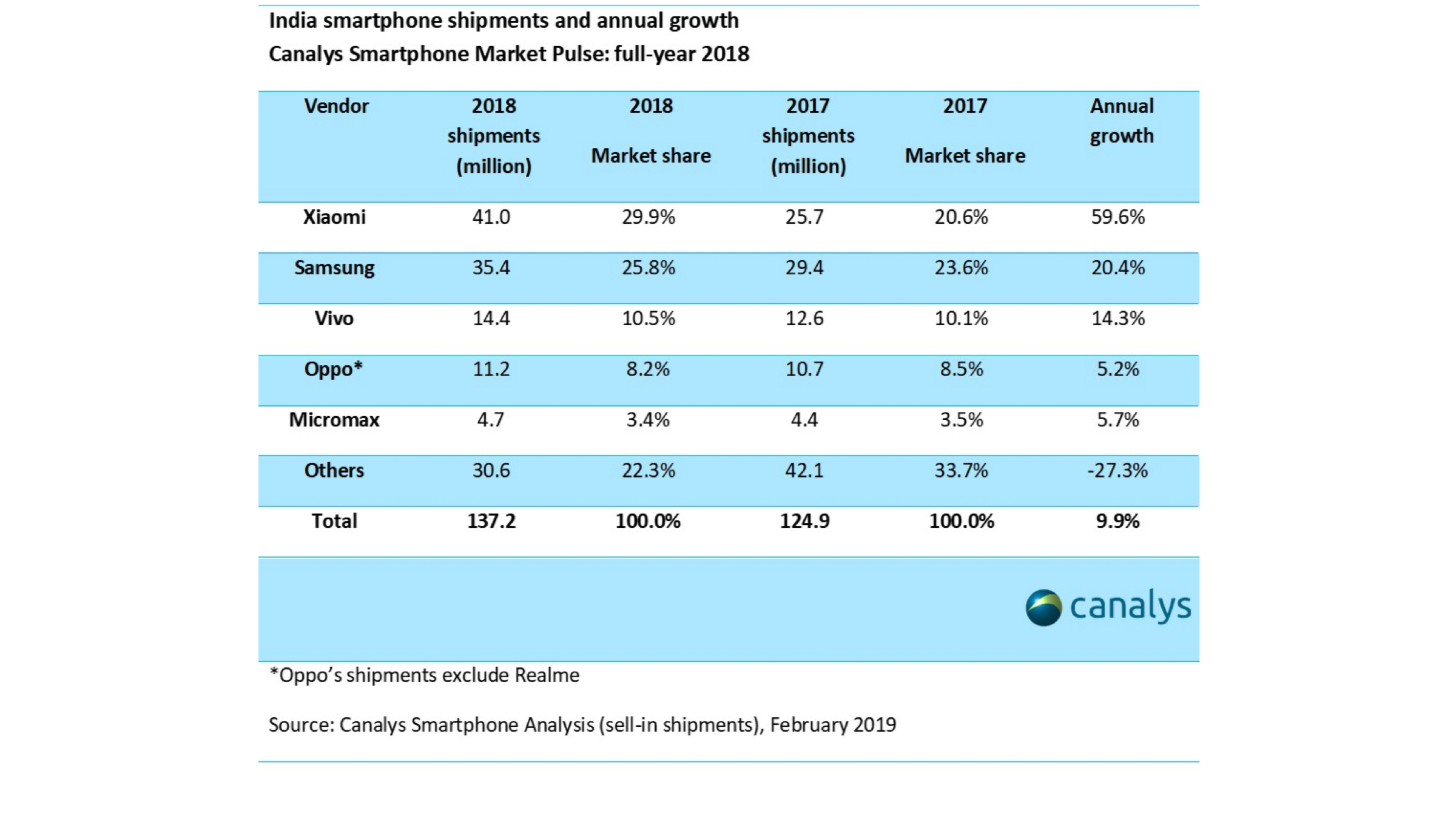

Furthermore, it has been reported that the most popular price range for smartphone is the INR 10,000 to INR 20,000 bracket. It includes all the mid range or affordable flagships which have become increasingly popular in the country. The handset trends such as notch display, multiple rear cameras, pop up selfie feature and in-display sensor technology are also being catered to in this price range to attract customers. The top 5 most popular brands in the Indian smartphone market from 2018 have seen some gains and losses but for the most part are still relevant.

Also Read: Motorola Launches The Moto E6 With Snapdragon 435 & 2GB RAM

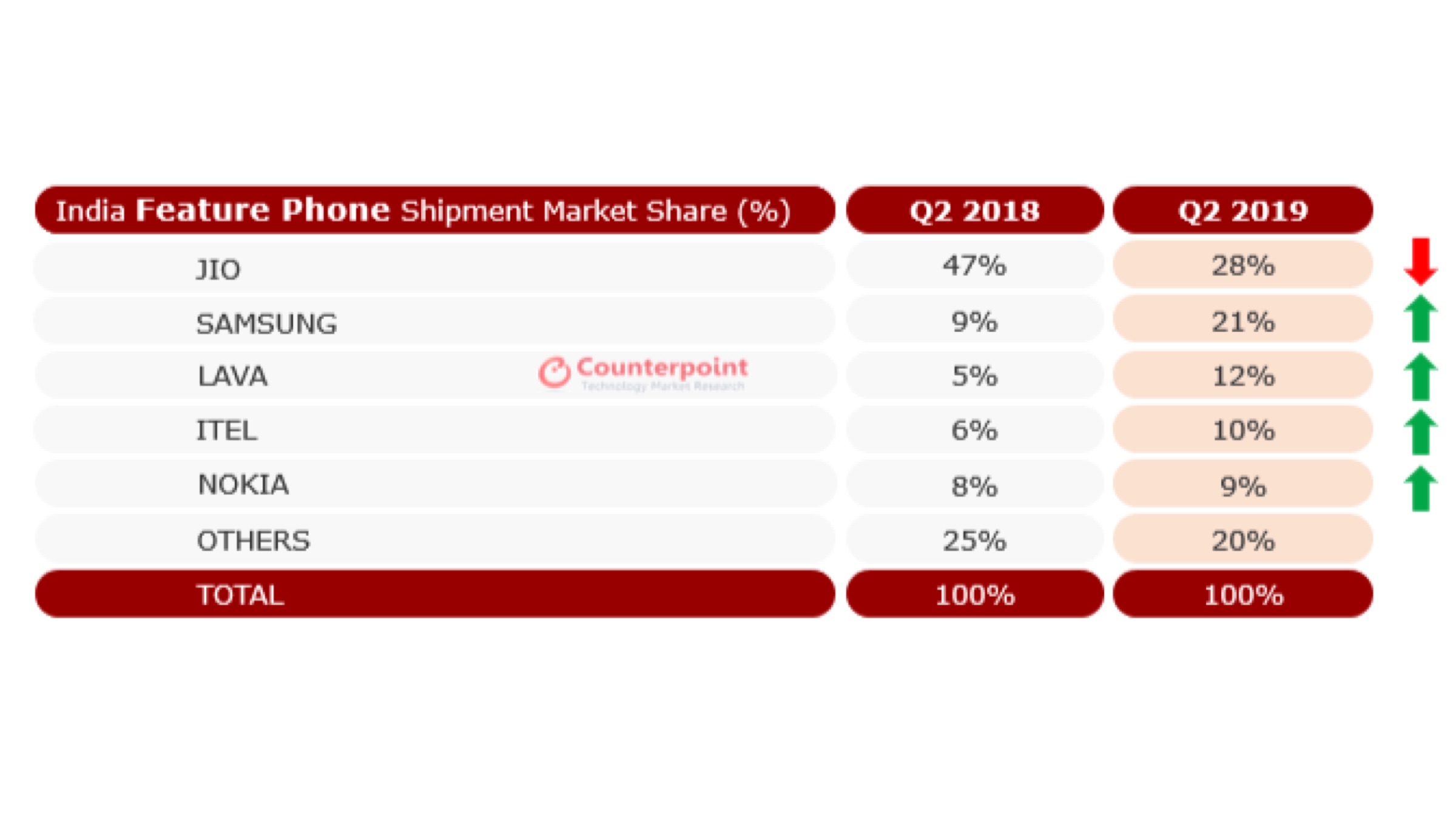

As the smartphone market grows, the older feature phones are currently witnessing a sharp decline in sales volume. A steep dive of 39% is being observed in the latters sales every year. The market research report shows the Indian smartphone markets potential for further growth. Companies such as Apple and LG taking initiative to start manufacturing in India is another great plus point. Made in India smartphones are cheaper than the shipped from abroad and are a great offering. All in all, the industry is brimming with choices and the current era is a golden age for customers.