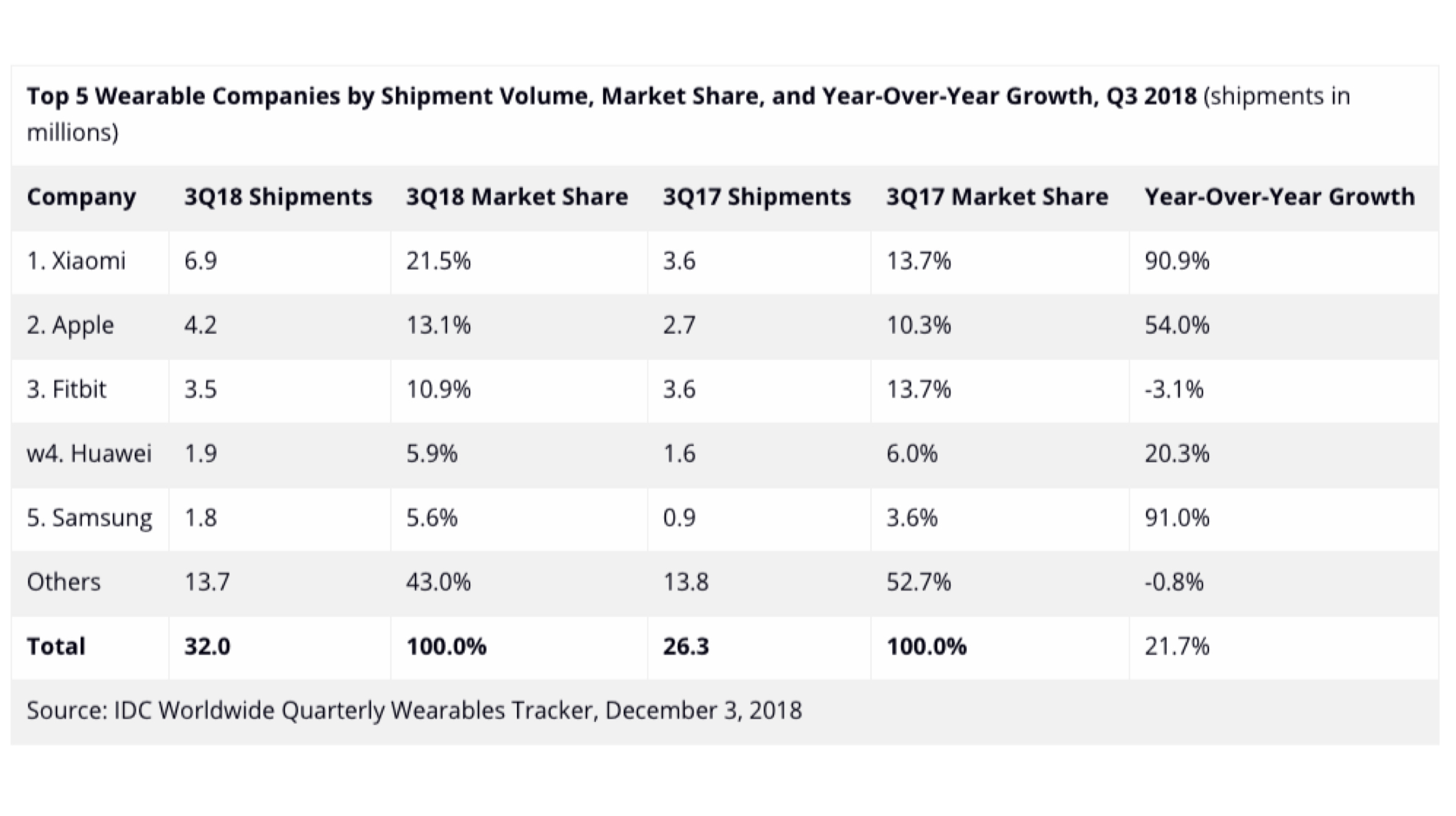

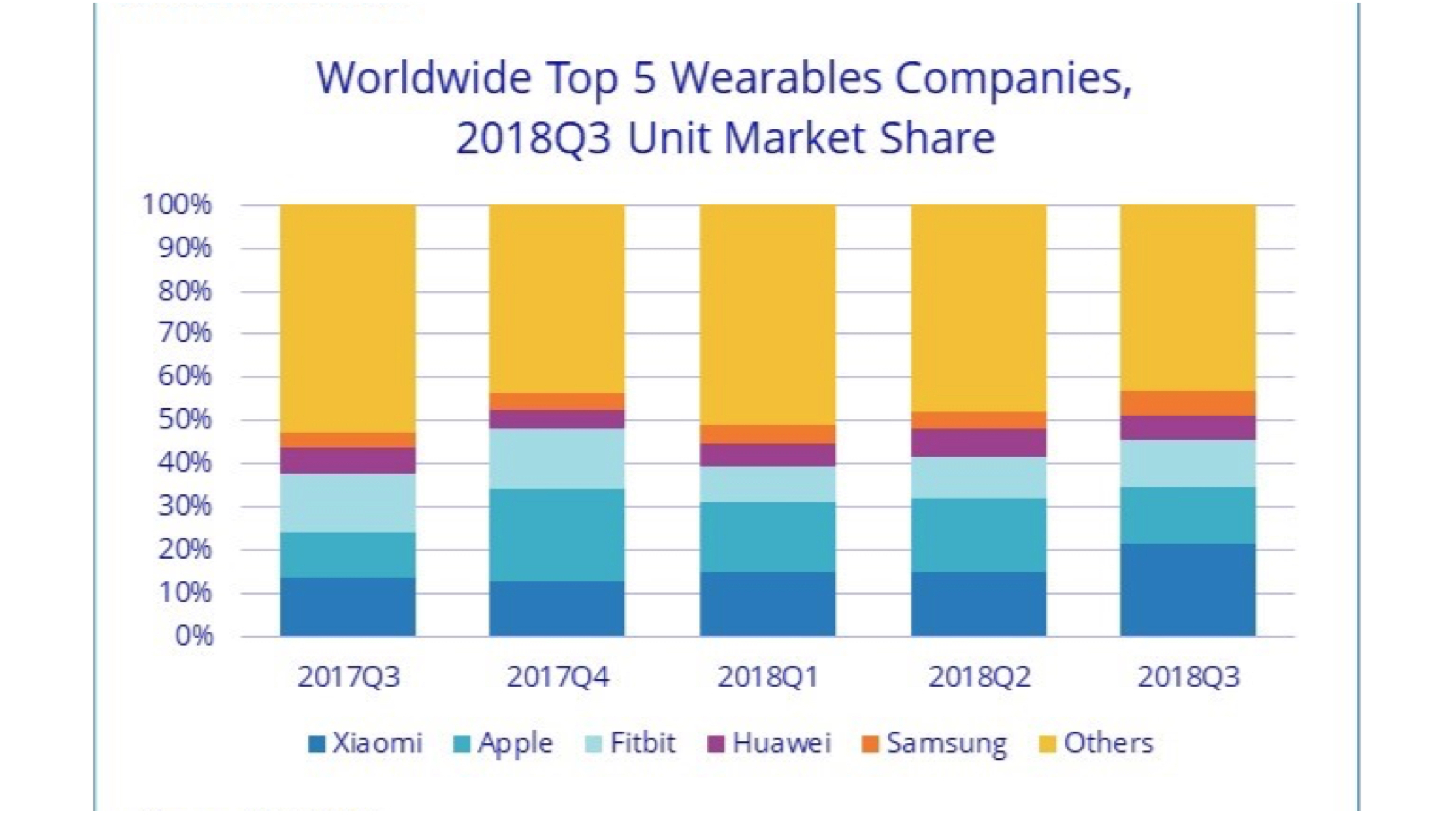

IDC short for International Data Corporation has revealed that global shipments of wearable devices have grown significantly YoY from the year 2017 to 2018. The biggest gainer in market share and the top spot for the maximum number of devices sold is held by Xiaomi. The full chart for shipments from different companies can be found below.

According to the report published by IDC, Xiaomi sold 6.9 million wearable devices in Q3 of 2018, up from 3.6 million in Q3 of 2017. Major contributors in Xiaomi’s portfolio is the Mi Band which is an affordable fitness band. Noteworthy, Xiaomi’s stake grew from 13.7 percent to 21.5 percent which is significant growth.

According to the report published by IDC, Xiaomi sold 6.9 million wearable devices in Q3 of 2018, up from 3.6 million in Q3 of 2017. Major contributors in Xiaomi’s portfolio is the Mi Band which is an affordable fitness band. Noteworthy, Xiaomi’s stake grew from 13.7 percent to 21.5 percent which is significant growth.

Following Xioami in the list is the American giant, Apple which sold 4.2 million smart wearables in Q3 of 2018. The devices in Apple’s portfolio include the Apple Watch and Apple AirPods. In comparison to Q3 of 2017, Apple saw close to 3 percent growth in the overall marketshare which grew from 10.3 percent to 13.1 percent.

Coming in at number three is Fitbit whose sale fell slightly YoY. In the Q3 of 2017, the company sold 3.6 million wearables, whereas in Q3 of 2018 it sold 3.5 million units. The overall YoY growth for the company fell over 3 percent. In Q3 of 2017 Fitbit had a market share fo 13.7 percent which fell to 10.9 percent in third quarter of the following year.

Other companies including Huawei and Samsung also sold a considerable amount of wearable devices in two years. Both companies saw an upward trend in terms of sale. Noteworthy, the market share of Korea based Samsung grew 91 percent between the two time frames. The company sold 0.9 million wearable devices in the third quarter of 2017 which double to 1.8 million for Q3 of 2018.

Also Read: Huawei Cancels MateBook X And E Over US Trade Ban

Conclusively, the data reveals that the demand for wearable devices is seeing rapid growth and 2019 is expected to translate into the charts climbing even higher.