Samsung and Apple may be rivals in the smartphone domain but, Samsung has always manufactures key components of the iPhone including the displays. And it looks like with the iPhone X, Samsung is poised to make a lot of money. Studying the costs of the components Samsung has made for the iPhone X, it reveals that the South Korean tech giant will earn about US$110 for every iPhone X sold.

A market research study conducted for the Wall Street Journal says that Samsung also makes batteries and capacitors for the flagship iPhone X. The highest-profile Samsung component in the iPhone X is also the most expensive, the new OLED screen. This is a custom-made display built to Apple’s specifications. The analysis reports states:

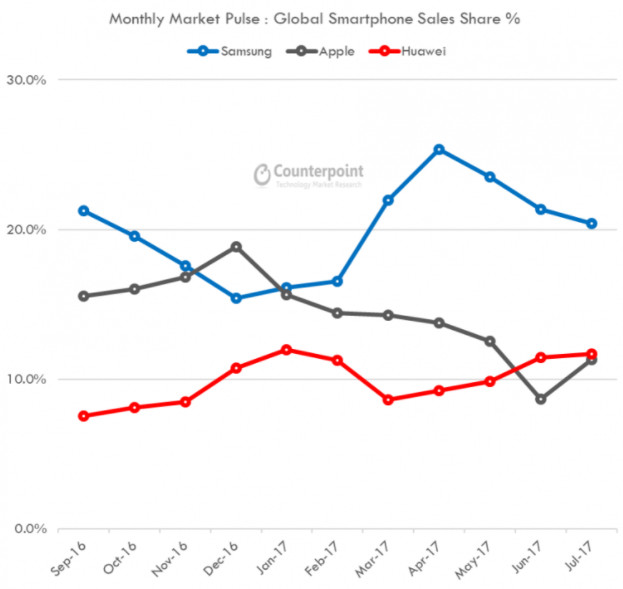

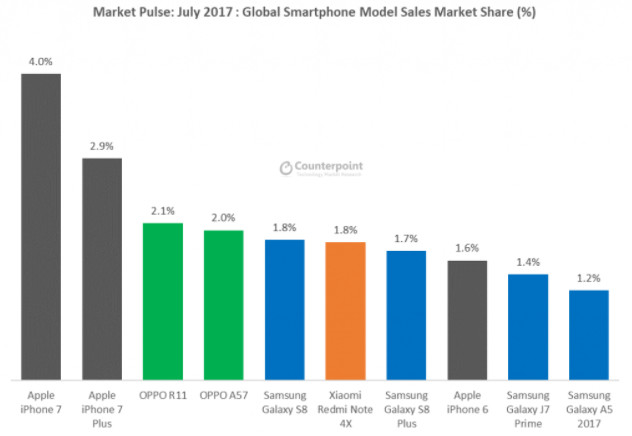

Samsung is likely to earn about $4 billion more in revenue making parts for the iPhone X than from the parts it makes for its own flagship Galaxy S8 handset. Counterpoint expects Apple will sell 130 million iPhone X units, earning Samsung $110 on each through the summer of 2019, while Galaxy S8’s global sales are expected to be 50 million, earning Samsung $202 each from components such as displays and chips in its first 20 months of sales.

You may also like : iPhone X Vs The Competition

The analysis, even though notes the irony is not a fair comparison. The research notes the profit Samsung’s component division makes for the Galaxy S8 but, not the mobile division makes for Galaxy S8 sold. Samsung obviously makes more money by selling its own smartphone because it makes more components for it but, since the iPhone X is expected to sell in far higher volumes, the total value of component sales will be higher for the iPhone. A report by investment bank CLSA estimated that Apple’s component orders make up more than a third of Samsung’s revenue. Oh, the irony.