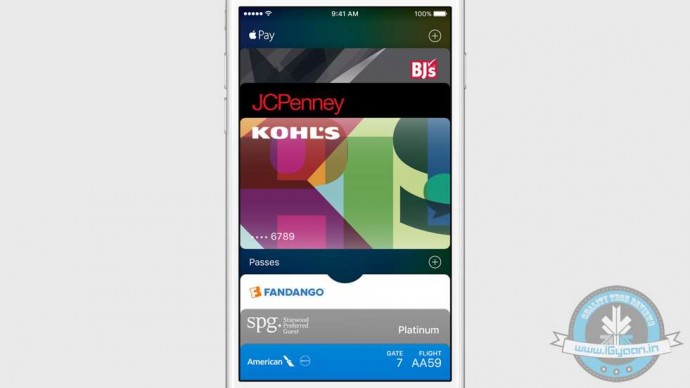

Apple is planning to bring its payment service, Apple Pay in India. During his recent visit to India, Eddie Cue, SVP for internet services and software admitted that seeing more and more international payment mechanisms entering India has encouraged Apple as well. Earlier in September, iGyaan had reported that Apple has begun testing Apple Pay in India and launch the payment service by the end of 2017.

It is great that all of these payment mechanisms is coming out in India because it empowers people to be able to pay. What Apple pay does is make that process easy, integrated and safe. We absolutely want to bring Apple pay to market here

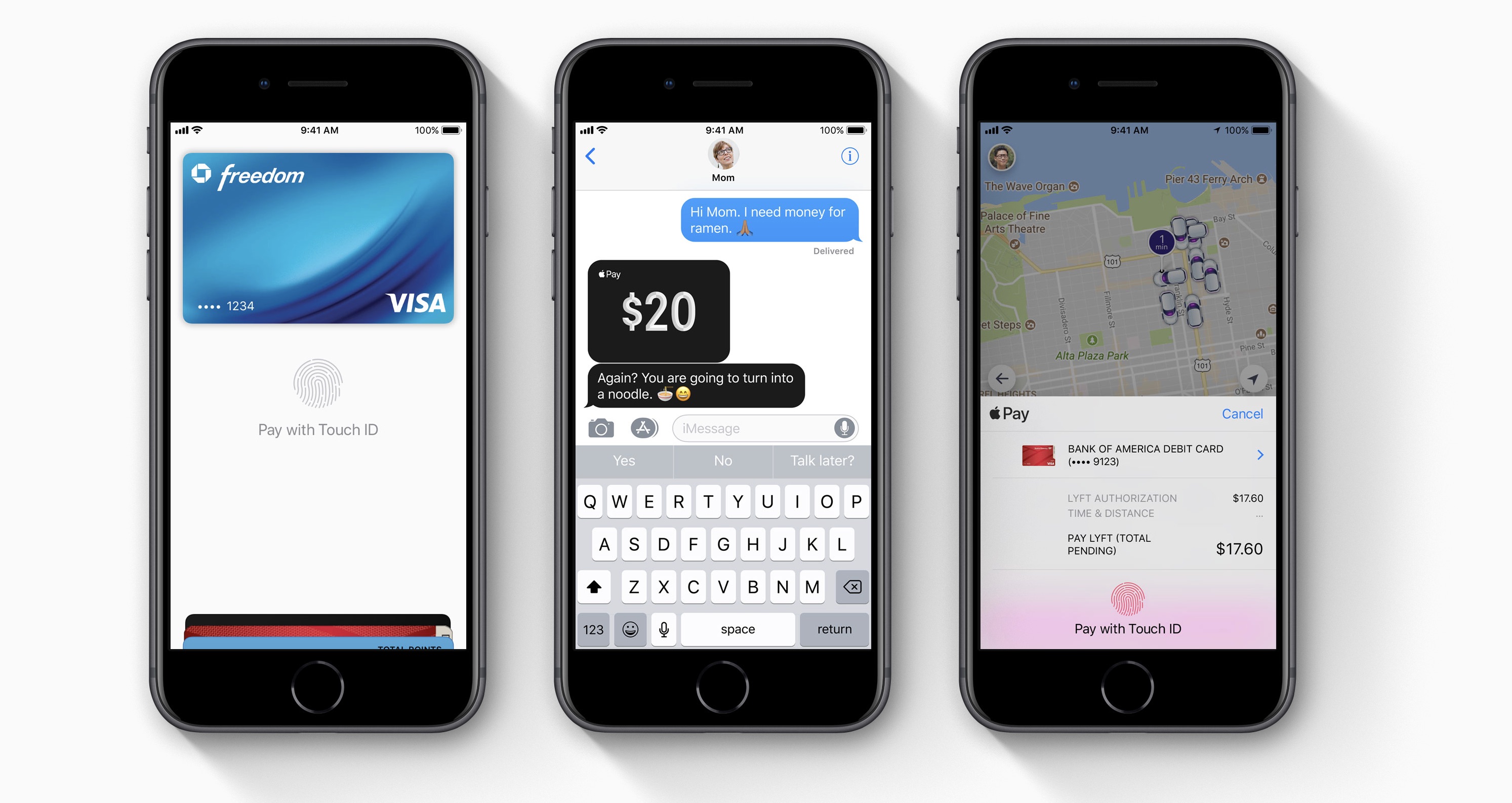

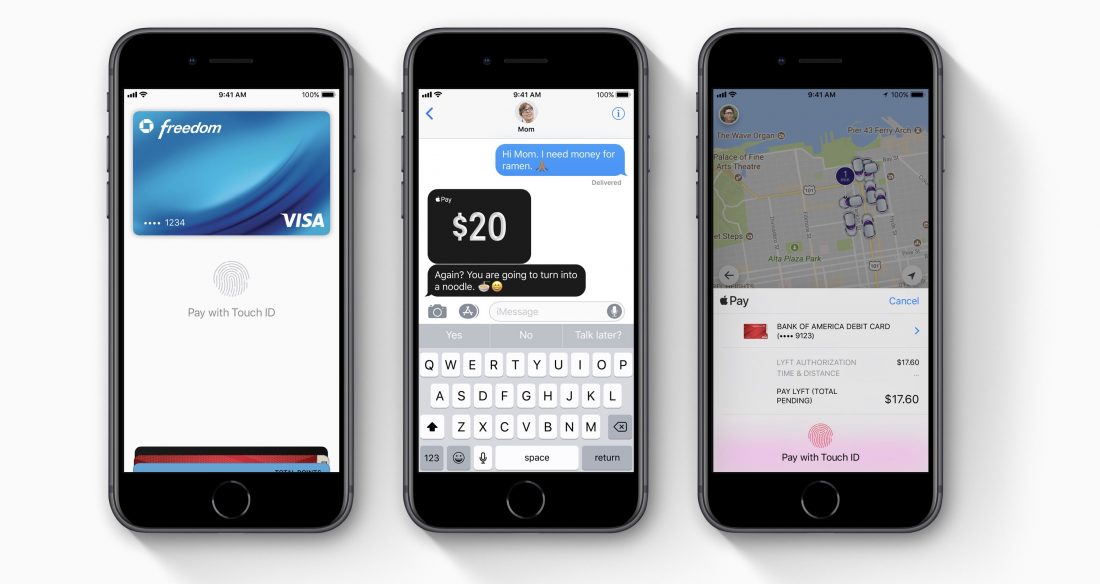

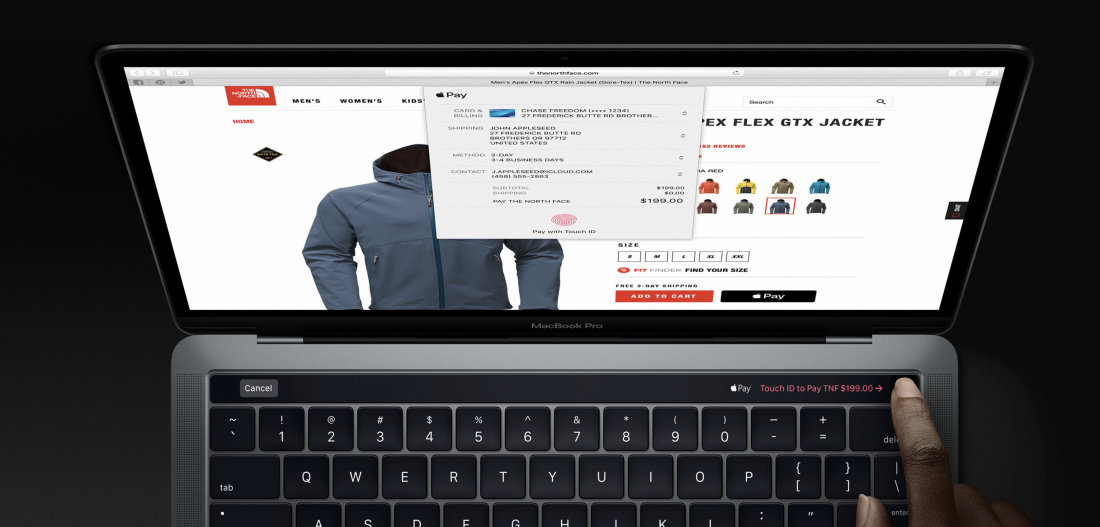

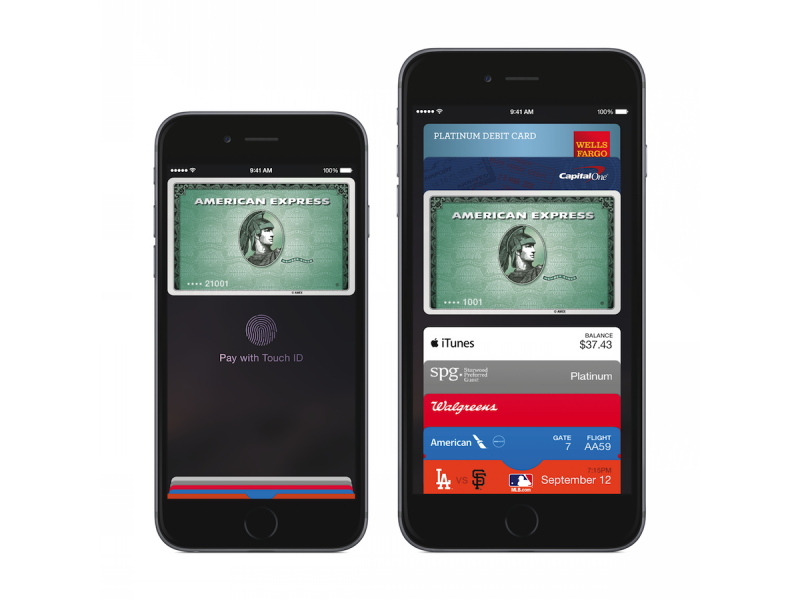

Apple Pay securely stores credit cards, debit cards, or other sensitive payment information from the Wallet app and lets the user pay for goods directly from their mobile device. For Apple Pay to work, the merchant needs to have a contactless machine which is compatible with Apple Pay. During the transaction, TouchID or FaceID is required to authenticate the payment. Once the authentication is successful, a subtle vibration confirms that the transaction was successful.

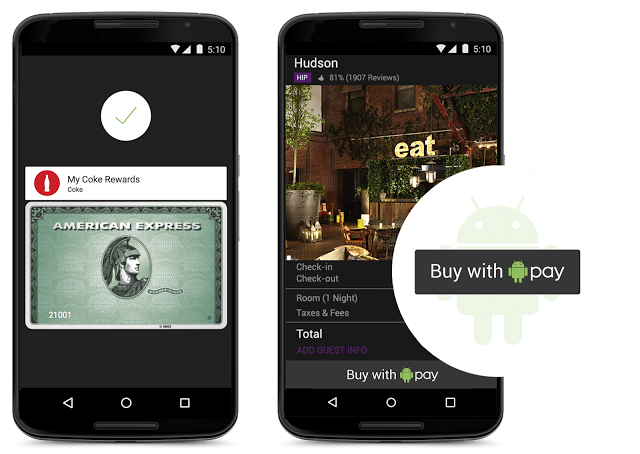

India has seen a floury of different payment services entering the country. Tech giants like Google, WhatsApp and Samsung has launched their payment services in India in the last couple of years. Other online payment apps like PayTM also allow its users to make cardless payments directly through the PayTM app, although, you need to top up your PayTM balance before making any transactions. In the case of Samsung and Apple Pay, transactions are made directly from the credit or debit card synced with your account.

Google launched Tez in early September in India. The app has a widespread support of banks and has already hit over 5 million downloads on the Play Store.

Apple may be late to join the online or cardless payment services party but, Apple is India’s second largest premium smartphone maker along with Apple Pay’s integration with iOS 11 and the Apple ecosystem will be a huge factor.